1041 Review: Trust & Taxes

Nobody wants to pay more taxes than they must. When it comes to taxation though, not all entities are treated equally. Trusts, in particular, are among the most heavily taxed. Unlike individuals, trusts have significantly compressed tax brackets and severely reduced deductions.

Let’s see if the following strategy can help you defer taxes that would otherwise trim your trust. We’ll meet Greta Erskine who feels that the taxes her trust pays are harming its legacy.

Greta's Credit Shelter Trust

Goal: Reduce Taxes

$38,673.50! That's what my Trust paid in taxes last year. I need help with that. My CPA says I should distribute the income.

Goal: Legacy

Paying those taxes had me taking assets from my trust that are supposed to go to my children.

In 2005, Greta’s husband, Abraham, passed away, leaving her in charge of his testamentary Credit Shelter Trust. Then, as now, the goal was to maximize the legacy that they could pass on to their family. Times have certainly changed, but the irrevocable nature of the Credit Shelter Trust trust has not.

Due to the balanced investments in the trust, the trust incurs ordinary dividends and interest income each year. While Greta is generally not adverse to receiving income from her investments, this trust was setup for her legacy, her children, not her income needs. Greta’s CPA has told her she should consider distributing the trust’s income to lower the trust’s overall tax burden. While this makes sense, Greta doesn’t want the income. After all, this trust is for her children; she has enough for herself. Thus, she reached out to her Design Team at Lorio Wealth Management and asked if there might be a better approach.

Goal: Reduce Taxes

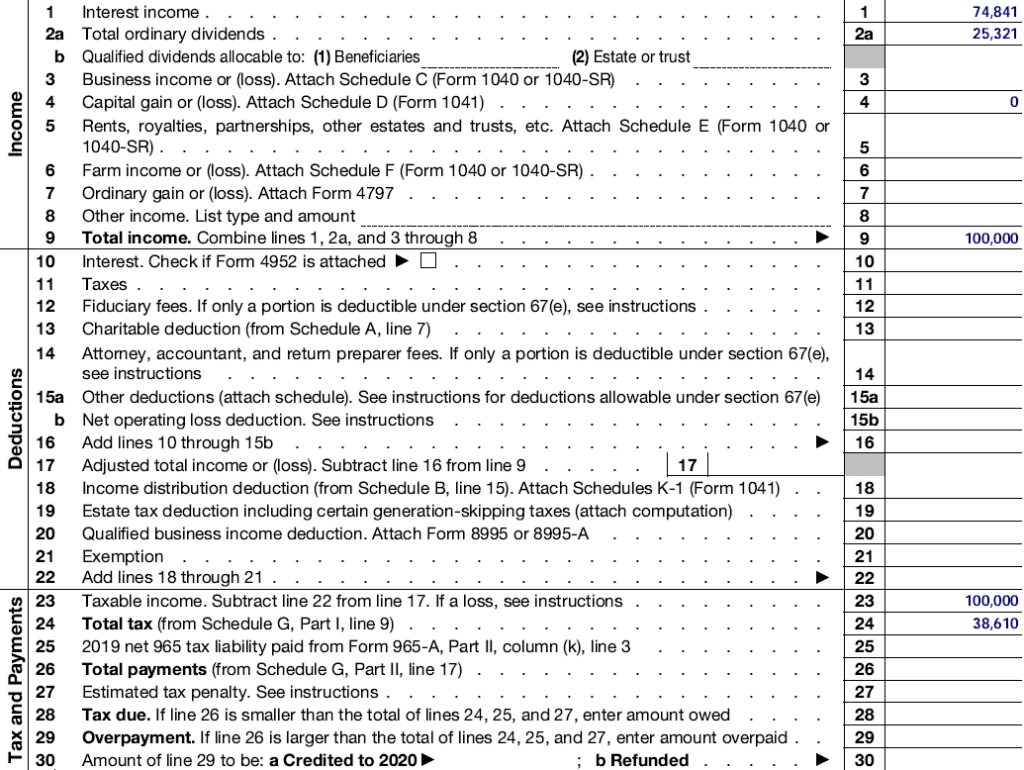

BEFORE

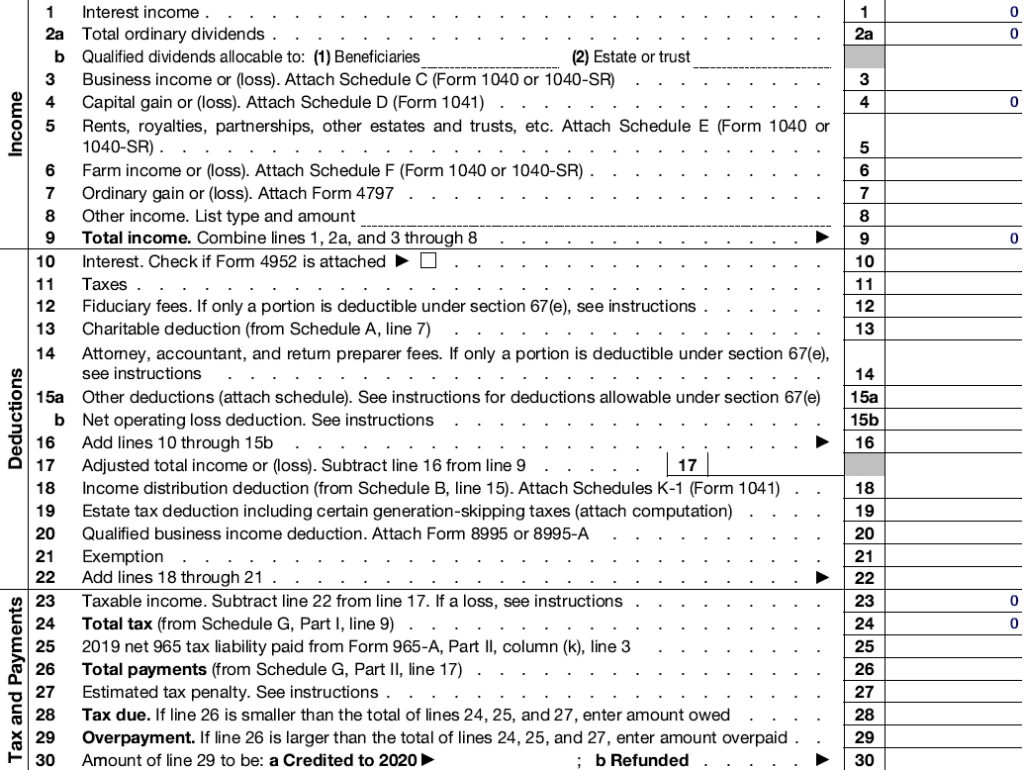

AFTER

IMPACT

Tax Deferral & (u)

That’s quite a change! How did her team help Greta reduce her trust’s Total Tax to $0? The answer is in I.R.C. § 72(u)(1).

I.R.C. § 72(u)(1)

What we see is that if an annuity, a tax deferred vehicle, is held by a trust as agent for a natural person, it qualifies for the exemption. Since this trust is for the benefit of Greta and her children, so long as the trust holds an annuity that names them as beneficiaries, it will meet the exemption provided under I.R.C. § 72(u)(1) and gain the benefits below.

Treatment Of Annuity Contracts Not Held By Natural Persons

In General – If any annuity contract is held by a person who is not a natural person

such contract shall not be treated as an annuity contract for purposes of this subtitle (other than subchapter L), and

the income on the contract for any taxable year of the policyholder shall be treated as ordinary income received or accrued by the owner during such taxable year.

For purposes of this paragraph, holding by a trust or other entity as an agent for a natural person shall not be taken into account.

Tax Deferral

Since the trust is invested in a tax-deferred vehicle, the annuity, it no longer has recognizable Interest Income on Line 1, Ordinary and Qualified Dividends on Line 2a and 2b, nor Capital Gains or Loss on Line 4. Instead, income, dividends, and gains, if any, grow tax deferred.

This is how the trust’s Total Tax on Line 24 fell to $0.

Distribution Control

Since the Total Tax on Line 24 is $0, there’s no need for Distributable Net Income on Form 1041, Schedule B, Line 7. Now, taxes will no longer trim the trust’s true goal.

Instead, requested distributions can be paid if required or when needed, but, if not needed, those assets can simply grow tax-deferred!

Goal: Legacy

BEFORE

AFTER

IMPACT

The true goal of the trust was creating a strong financial legacy for Abraham and Greta’s family. Their children, grandchildren, and perhaps one day great-grandchildren, have always been the focus.

This is why the taxes on the trust’s income have always been an issue. In the past, Greta’s choices were to pay the taxes with trust assets or to distribute the income, but no matter which choice she made, it diminished the trust’s legacy.

With the trust held annuity though, tax concerns are a thing of the past. Now, the trust continues to accumulate on a tax-deferred basis, allowing it to achieve greater heights.

Summary

Greta had 2 goals when she reached out: reduce taxes and legacy. Let’s see how the Design Team did for her.

The Design's Team's Impact

Goal: Reduce Taxes

Goal: Legacy

Take Action

Now, it’s your turn! Reach out to the Design Team at Lorio Wealth Management below!

Disclosures

This material has been prepared for informational purposes only, and is not intended as specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

What are annuities?

https://www.investor.gov/introduction-investing/investing-basics/investment-products/insurance-products/annuities

Appendix A: Tax Forms

Before - 1041

After - 1041

Appendix B: Methodology

Legacy

In determining the additional dollars for beneficiaries, we utilized the below base facts.

Purpose:

Credit Shelter Trust

Created:

2005

Funding Amount:

$1,500,000

Portfolio:

60% Fixed Income represented by the Barclay’s U.S. Aggregate Bond Index

40% U.S. Stocks represented by the S&P 500 Index

The portfolio was evaluated using the last 15 years of historical data for each index with the ordinary dividends taxed at trust tax rates for the taxable account. Each account was accessed a 1% fee for advisory services. In comparing the accounts, after 15 years, the taxable account grew to $2,901,598.19. The tax deferred account grew to $3,399,513.76.

Each account was distributed at Married Filing Jointly rates at the end of the 15th year. The taxable account distributed $2,444,866.86 after taxes. The tax deferred account distributed $2,858,553.67 after taxes.

Tracking #1-05037225